Dealers

Advanced Identity Verification for Dealership Security

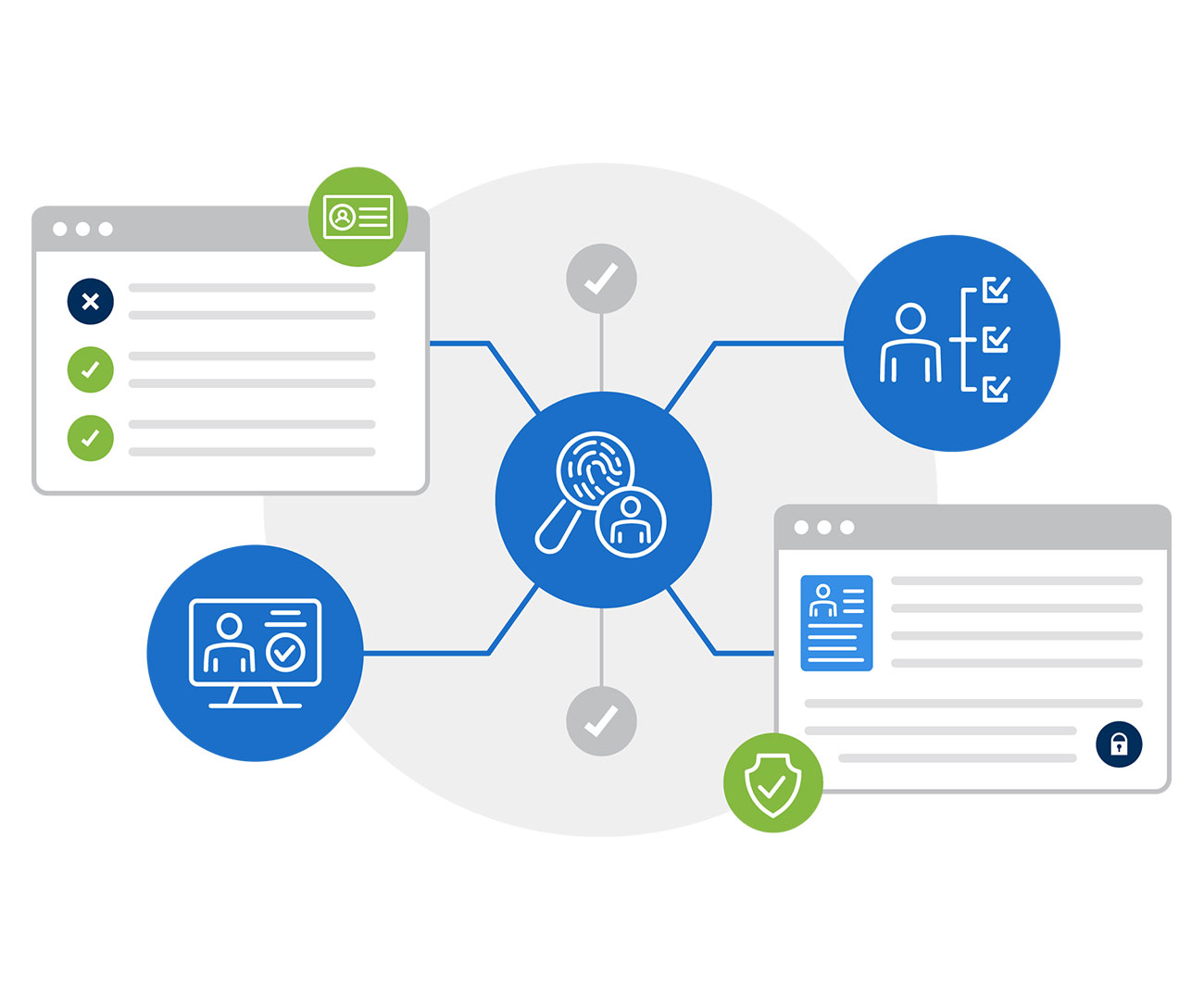

How do you keep your dealership safe from the constant threat of identity theft? A verification tool like IDOne can help you manage your day-to-day compliance needs and validate consumer identities.

IDOne is a full-service identity verification tool that helps manage your compliance tasks and fits seamlessly into your everyday RouteOne workflow. Validate identities and pinpoint potential fraud without missing a beat. We automatically generate additional quizzes in real-time when needed, taking the manual work out of determining potential issues. You have the option to subscribe to IDOne with 700Credit, NCC, Point Predictive, or TransUnion®.

Customizable settings give you the flexibility to set tolerances for alerts so you can decide the appropriate risk strategy for your dealership. Results are found in RouteOne’s Deal Manager, along with the ability to review and override any red flag cautions manually. It’s another piece of your compliance workflow designed to keep you safe and selling.

Key Benefits & Features

Protect your dealership by validating identities directly within RouteOne

Set preferences to auto-run IDOne every time you pull a credit bureau

Verification with multiple databases to identify discrepancies

Select from four providers - 700Credit, NCC, Point Predictive, or Transunion

Eliminate duplicate data entry by automatically populating your RouteOne credit app with data used from IDOne

Automates audit trails and record-keeping

Protect Your Dealership Against Identity Theft

IDOne is a full-service identity verification and authentication tool that compares an applicant’s data with multiple databases and alerts dealers when there's a potential issue. Watch the short video below to learn more.

IDOne Product Options

Let RouteOne help you manage your day-to-day compliance needs and pinpoint potential identity fraud. Subscribe to IDOne with 700Credit, NCC, Point Predictive, or Transunion®.

700Credit Options

OFAC Checks

Warning Messages for High-Risk Applicants

Option to Generate Risked-Based Identity Quizzes

Use of Non-Credit Based Questions

Multiple Database Checks

Numeric Scores for Threat-Level Access

Synthetic Fraud ID Detection – 30+ Credit File Factor Checks Evaluate Credit Behavior

Military Lending Act (MLA) Review

NCC Options

OFAC checks

Warning Messages for High-Risk Applicants

Option to Generate Risked-Based Identity Quizzes

Use of Non-Credit Based Questions

Multiple Database Checks

Numeric Scores for Threat-Level Access

Synthetic Fraud ID Detection

Military Lending Act (MLA) Review

Point Predictive Options

OFAC checks

Warning Messages for High-Risk Applicants

Option to Generate Risked-Based Identity Quizzes

Use of Non-Credit Based Questions

Multiple Database Checks

Synthetic Fraud ID Detection

Military Lending Act (MLA) Review

TransUnion Options

OFAC checks

Warning Messages for High-Risk Applicants

Automatically Generate Risked-Based Identity Quizzes

Use of Non-Credit Based Questions

Multiple Database Checks

Subscribe to IDOne

Your Dealer System Administrator (DSA) can subscribe to IDOne in the Admin tab of the RouteOne system with your preferred provider. More questions? Connect with the RouteOne Service Desk at 866.768.8301 or log into RouteOne and click the ‘Live Chat’ button for assistance.